Testing Limited Commitment: Food vs Non-Food Insurance in Rural Uganda

Testing Limited Commitment: Food vs Non-Food Insurance in Rural UgandaAbstract

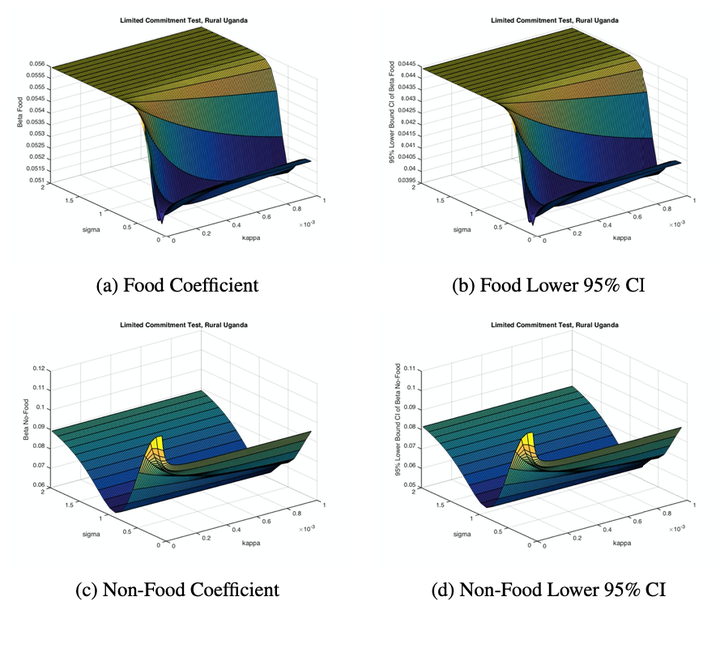

“Households’ income fluctuations in poor countries call for risk smoothing mechanisms, yet insurance is always found to be incomplete. We build a two-goods complete markets model, and confirm this result with the UNPS - a new representative Uganda household-level panel data. The empirical evidence suggests that the degree of consumption insurance differs across consumption goods: Households insure food better than other non-durables. This finding has potential policy implications (e.g., consumption-item specific such as food coupons).”